You know that old saying about projects: “Fast, cheap, good – pick two”? Well, blockchain has its own version of this cruel joke, and it’s been driving developers crazy for over a decade.

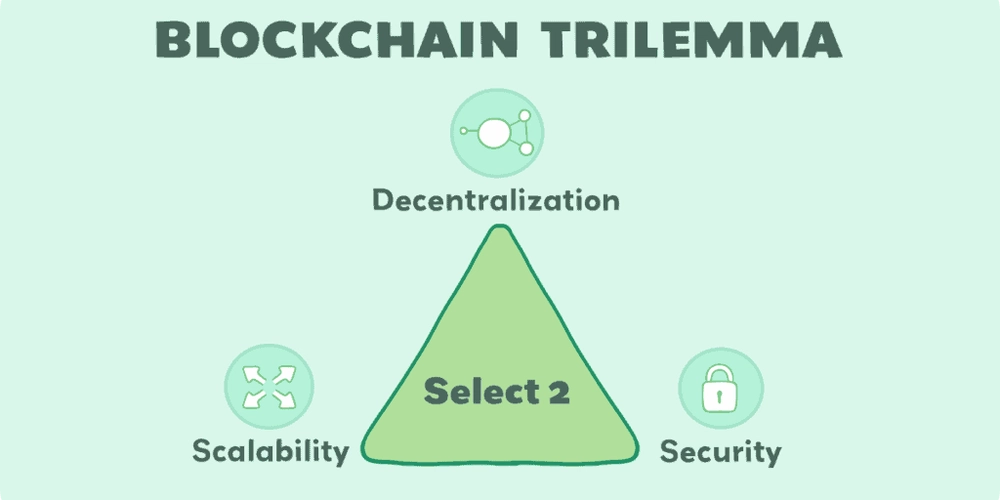

Welcome to the blockchain trilemma, where you get to choose between decentralization, security, and scalability but you can only have two. It’s like being forced to pick your favorite child, except your children are fundamental properties of a distributed network, and the stakes are billions of dollars.

The Three Pillars (And Why You Can’t Have Them All)

Let’s break down what we’re actually talking about here.

Decentralization means no single entity controls the network. Think thousands of nodes scattered across the globe, each with equal say in what transactions are valid. It’s democracy for databases.

Security means the network can’t be hacked, manipulated, or broken. Your transactions are safe from bad actors, even if they control significant resources.

Scalability means the network can handle lots of transactions quickly and cheaply. We’re talking Visa level throughout thousands of transactions per second without breaking a sweat.

Sounds simple enough, right? Just build a network that’s decentralized AND secure AND scalable. What could go wrong?

Everything, it turns out.

The Physics of Distributed Systems

Here’s the thing nobody wants to admit: the blockchain trilemma isn’t just a technical challenge, it’s physics. When you add more decentralization, you inherently slow things down because more nodes need to agree on every transaction. When you prioritize speed, you usually end up concentrating power in fewer hands. When you maximize security, you often sacrifice both speed and accessibility.

It’s like trying to have a conversation with 10,000 people at once while ensuring nobody lies and everyone hears everything perfectly. Good luck with that.

Real World Trade offs in Action

Let’s look at how actual blockchains handle this impossible choice:

Bitcoin picked decentralization + security, and the result is… well, you’ve probably waited 30 minutes for a Bitcoin transaction to confirm. Bitcoin processes about 7 transactions per second. Your local coffee shop’s payment processor laughs at those numbers.

Ethereum tried to have it all and ended up with gas fees that cost more than a nice dinner during peak times. When everyone wanted to buy digital cats (remember CryptoKitties?), the entire network ground to a halt. Ethereum chose security and reasonable decentralization, but scalability became a very expensive problem.

Binance Smart Chain said “screw it” and picked scalability + security while quietly sacrificing decentralization. With only 21 validators, it’s basically a traditional database with blockchain makeup. Fast? Yes. Cheap? Absolutely. Decentralized? About as much as your local bank.

The “Solutions” That Aren’t Really Solutions

Every few months, some new blockchain claims to have “solved” the trilemma. Spoiler alert: they haven’t.

Layer 2 solutions like Polygon and Arbitrum promise to scale Ethereum while keeping it secure and decentralized. But here’s the catch they’re essentially building new, less secure networks on top of Ethereum. You’re trading security for speed, just with extra steps and marketing.

Sharding sounds great in theory – split the blockchain into pieces so different parts can process transactions simultaneously. Ethereum 2.0 has been promising this for years. But coordination between shards creates new attack vectors, and you’re essentially making trade offs between security and complexity.

Proof of Stake was supposed to solve everything by making consensus more efficient. Ethereum’s switch to PoS did improve energy efficiency, but it didn’t magically make the trilemma disappear. You still can’t have infinite decentralization, perfect security, and unlimited scalability.

When “Blockchain Killers” Hit Reality

Remember when Solana was going to “kill” Ethereum with its blazing fast transactions and low fees? Then the network went down. Multiple times. Turns out when you optimize for speed, reliability becomes… optional.

Avalanche, Cardano, Polkadot yeah they all claimed breakthrough solutions to the trilemma. But look closer, and you’ll find the same trade offs, just dressed up differently. Fewer validators here, higher hardware requirements there, more complex consensus mechanisms that most people don’t understand.

It’s not that these projects are bad they’re just honest about different priorities. The dishonest part is claiming they’ve transcended fundamental laws of distributed systems.

Why This Matters for Real People

This isn’t just academic navel gazing. The trilemma affects everyone who touches crypto:

That $50 Ethereum transaction fee? That’s the cost of security and decentralization. Those network outages on your favorite DeFi protocol? That’s the price of pushing scalability too hard. That new “revolutionary” blockchain that only has 10 validators? That’s what giving up decentralization looks like.

Every time you use a blockchain application, you’re experiencing someone’s choice about which part of the trilemma to sacrifice. High fees, slow transactions, or trusting a small group of validators so yeah pick your poison.

The Uncomfortable Truth

Here’s what the blockchain industry doesn’t want to admit: the trilemma might not be solvable. Not because we’re not smart enough, but because it might be a fundamental law of distributed systems just like entropy or gravity.

Think about it: truly decentralized systems require coordination among many independent parties. Coordination takes time. Security requires redundancy and verification. These aren’t engineering problems you can code your way out of they’re literally mathematical realities.

Maybe the question isn’t “How do we solve the trilemma?” but “Which trade offs make sense for different use cases?”

Different Networks, Different Choices

Bitcoin’s choice makes sense if you want digital gold something rare, secure, and censorship resistant. Speed doesn’t matter if you’re storing value for decades.

Ethereum’s approach works if you want a platform for complex applications where security matters more than transaction costs. You’re building the foundation of decentralized finance, not processing coffee purchases.

Binance Smart Chain’s trade offs make sense if you want to experiment with DeFi without paying insane gas fees, and you’re okay trusting a relatively centralized system.

None of these choices are wrong they’re just different answers to an impossible question.

The Future of “Good Enough”

Maybe the blockchain industry needs to stop promising to solve unsolvable problems and start being honest about trade offs. Maybe we need different blockchains for different purposes, instead of one blockchain to rule them all.

Perhaps Bitcoin can be the slow, secure, decentralized store of value. Ethereum can be the secure platform for high value applications. Faster chains can handle everyday payments and gaming. And centralized databases can keep doing what they do best for everything else.

The trilemma isn’t a bug to be fixed, it’s a feature that forces us to think carefully about what we actually need from our systems.

Conclusion: Embrace the Trade offs

The blockchain trilemma isn’t going anywhere. Every time someone claims to have solved it, they’ve usually just hidden the trade offs or shifted them somewhere else. That’s not failure that’s just physics.

The sooner we stop pretending we can have it all, the sooner we can build systems that are honest about what they optimize for. Fast, cheap, and decentralized remains a fantasy. Fast and cheap? Sure. Secure and decentralized? Absolutely. But all three?

You still have to pick two.

And maybe that’s okay. Maybe the real innovation isn’t solving the trilemma, it’s being honest about which two you chose, and why.

So let me know what’re your thoughts on the BlockChain Trilemma?

Can there ever be a lasting solution to it?