Enterprise AI initiatives often follow a predictable pattern. They launch with ambitious goals: “We need AI agents that can automate workflows, integrate with our systems, and execute complex business logic.” The demonstrations are compelling. The potential is clear.

But then the implementation reality sets in.

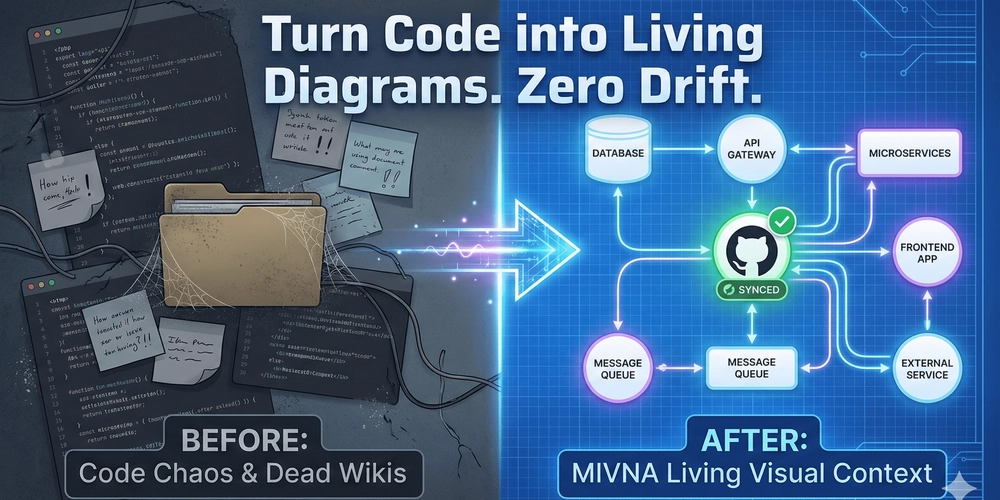

Months pass while teams wrestle with infrastructure challenges instead of focusing on intelligence. The problem isn’t that the AI lacks capability—it’s that organizations get bogged down in building infrastructure instead of moving quickly to bring solutions to market.

Most enterprise teams get trapped in endless cycles of integration work. They write custom code to connect APIs, stitch together services, debug fragile workflows, and make everything scale. By the time they’ve built the foundation, business requirements have evolved, and the cycle begins again.

Why Enterprise AI Gets Stuck

Understanding why promising AI initiatives stall requires examining the fundamental challenges that emerge when moving from concept to production.

API integration complexity represents one of the most significant bottlenecks. What appears simple on paper—connecting to existing enterprise systems—becomes an exercise in digital archaeology. Each system communicates differently, uses unique authentication schemes, and has distinct ideas about data flow.

In some cases, APIs need to be adjusted and require enhanced documentation Or converting them to MCPs so AI systems can understand how to use them effectively. Without this, integration work consumes weeks instead of days.

Building business logic requires significant resources. Developing and maintaining enterprise workflows, rules, and decision trees demands close collaboration between product managers, analysts, and developers. Translating high-level business requirements into executable code, handling exceptions, and ensuring consistency across systems requires significant effort. Complex rules often span databases, microservices, and legacy systems, making implementation time-consuming and error-prone. Even small changes in requirements can trigger substantial work to update and validate workflows, slowing iteration, increasing costs, and raising the risk of inconsistencies.

Workflow orchestration visibility poses ongoing challenges for complex AI systems. Multi-step processes involve interactions between various services, but traditional enterprise systems provide limited insight into these workflows. When issues arise—and in complex systems, they inevitably do—teams are left reconstructing events from scattered log files across different systems.

Scaling requirements expose the limitations of traditional enterprise architectures when faced with AI workloads. Production systems need to handle sudden spikes—market events triggering thousands of simultaneous alerts, or batch jobs processing millions of records in parallel. Building this infrastructure requires expertise in distributed systems, message queuing, load balancing, and fault tolerance patterns.

Governance and compliance considerations often emerge as afterthoughts, creating significant delays when teams realize they need comprehensive audit trails, access controls, and compliance monitoring. Retrofitting these requirements into existing systems isn’t just technically challenging—it requires coordination across security teams, legal departments, and compliance officers.

How Enterprises Try to Solve This Today

Organizations typically pursue one of several approaches to address these infrastructure challenges, each with distinct trade-offs.

Custom development efforts involve building orchestration and integration frameworks internally. This approach offers complete control and perfect alignment with specific organizational needs, but typically consumes entire engineering teams for months. Teams end up rebuilding infrastructure that already exists—message queues, workflow engines, monitoring systems—instead of focusing on their core business problems and AI capabilities.

More technically sophisticated organizations often choose robust messaging platforms like Kafka, RabbitMQ, or NATS as their foundation. These are proven, battle-tested systems capable of handling enormous volumes and complex routing patterns. The challenge is that they’re building blocks rather than complete solutions. Organizations still need to layer on orchestration logic, compliance monitoring, agent management, and comprehensive observability tools. What begins as a straightforward messaging implementation evolves into a complex system-of-systems requiring specialized expertise to maintain and operate.

Each approach addresses portions of the overall challenge, but none provides a complete solution that allows teams to focus primarily on AI logic rather than infrastructure complexity.

KubeMQ- Aiway: Next Generation Agentic Messaging Platform

KubeMQ‘s revolution in this space reflects an understanding of these enterprise realities. The company has been powering mission-critical messaging for finance, telecom, and defense organizations—environments where system reliability is paramount. Their development of KubeMQ-Aiway represents recognition that messaging alone isn’t sufficient for AI-driven enterprise requirements.

The platform combines proven enterprise messaging capabilities with the orchestration layer that AI agents require. Rather than treating messaging as merely a transport mechanism, the architecture integrates intelligence and workflow automation directly into the messaging foundation.

The approach offers several key capabilities: business logic can be written in natural language and automatically converted into executable workflows. API documentation—including comprehensive specification documents—can be uploaded to generate ready-to-use tools that agents can immediately consume. These tools abstract away the complexity of raw APIs, making them reusable building blocks across multiple workflows. Complex flows can then be assembled using these tools, with built-in parallelism and observability, all running on messaging infrastructure proven in production environments.

The architecture maintains enterprise reliability and security requirements while enabling the development speed that modern business environments demand.

Exploring KubeMQ-Aiway’s Features in Practice

Having recently explored KubeMQ-Aiway firsthand, I was able to see how its design reduces much of the complexity described earlier. Unlike traditional messaging platforms that require separate orchestration tooling, KubeMQ-Aiway brings everything into one workspace: tools, APIs, agents, and flows.

Tools & APIs

The Tools dashboard lets teams register any service API (e.g., proprietary systems, partner services, SaaS/market feeds). This means a team can quickly add a legacy CoreBanking API, a real-time MarketData feed, or a compliance service, and monitor usage directly. The platform supports both synchronous request/reply and streaming connections, all managed via KubeMQ’s underlying broker. This visibility ensures that when APIs misbehave or hit limits, teams see the warning signals before workflows break.

Agents

Aiway’s Agents panel shows how AI-powered components connect to tools. Each agent can be configured with:

-

An underlying model (e.g., GPT-5, Sonnet 4.1)

-

Natural language prompts that define its role (“You are a stock trading agent for our bank…”)

-

Flexible messaging patterns, enabling a single agent to coordinate multiple tools in different ways simultaneously. For example, the same agent might place portfolio-update requests into a queue for a risk analysis service, while also streaming real-time market data to a monitoring tool—all orchestrated from the instructions given in the prompt.

-

Linked tools it can call during execution

This capability is particularly important for enterprise workflows, where one agent often needs to manage different communication patterns across heterogeneous systems. Instead of splitting responsibilities across multiple agents or hardcoding integrations, teams can define rich, multi-tool behaviors within a single prompt. The result is tighter coordination, less fragmentation, and easier maintenance—while still providing complete transparency and auditability for compliance.

Flows

The Flow Editor is where orchestration happens. Teams can visually design sequences that link APIs and agents. For example, a TradingAgent might:

-

Pull account balance from CoreBanking via request/reply.

-

Validate KYC with CustomerKYC service using a cached check.

-

Run a compliance validation through the ComplianceAgent via pub/sub.

-

Forward results to a notification service for customer updates.

All of these are configured through drag-and-connect nodes, backed by KubeMQ’s messaging guarantees (queues, pub/sub, streams). The visual interface makes it clear how data flows, while the messaging backbone ensures it never gets lost.

Monitoring, Cost Control & Analytics

Aiway’s Analytics dashboard provides system-wide insight across operations, performance, and costs:

-

Message volume (e.g., 2.4M daily transactions)

-

Response times (e.g., 43ms average latency)

-

System health (e.g., 99.9% uptime)

-

Cost control metrics, including per-agent and per-tool usage tracking, allowing enterprises to monitor API call volumes, model consumption, and infrastructure load. This visibility helps teams forecast expenses, identify cost-heavy workflows, and optimize where necessary without compromising reliability.

Equally important, Aiway delivers deep observability into agent coordination and system behavior. Enterprises can trace message flows end-to-end, identify bottlenecks across distributed services, and drill down into per-agent execution details. With real-time dashboards, anomaly detection, and exportable audit logs, teams can ensure compliance while also improving operational efficiency.

This isn’t just cosmetic. For enterprise teams, observability and cost transparency are often the missing link. By unifying these capabilities in one platform, Aiway shortens mean time to detect and resolve issues, prevents cost overruns, and gives stakeholders the confidence that large-scale AI operations remain both sustainable and accountable.

Use Case Example: AI Index Fund Selection

In this use case, the bank wants to provide customers with an AI‑powered filtering service that goes beyond static programmatic checks. Customers may ask broader questions such as: Which S&P 500 index fund should I consider? or What robotics‑focused funds are available right now? Rather than replacing a financial advisor or giving prescriptive recommendations, the IndexAgent helps customers by narrowing down a large universe of funds into a filtered, ranked list that best matches their stated preferences, portfolio, and risk profile. The agent provides clear explanations of why certain options were selected, while still requiring the customer to make the final decision. This service adds value by simplifying complex fund choices into an understandable shortlist backed by real‑time data, portfolio alignment, and compliance checks.

Setup of the required tools

The bank uploads the API specs of its key services into the Tools tab. Each tool is registered separately:

MarketData provides live quotes, spreads, and constituents so the agent always works with the latest market context.

PortfolioService delivers current holdings and exposures, enabling personalized filtering aligned with customer portfolios.

RiskProfile supplies suitability and risk tolerance information to ensure shortlist results fit the customer’s profile.

CustomerKYC checks eligibility and residency rules, preventing options that customers cannot legally access.

BenchmarksAPI maps funds to benchmark indices, supporting comparisons across families like S&P 500 or sector‑focused indices.

NotificationService handles delivery of outputs such as shortlists and rationales directly to the customer portal or app.

Optionally, an Execution Broker API can be added if the customer later chooses to place an order, connecting shortlist results to trade execution.

Setting up the main Agent (IndexAgent)

The IndexAgent prompt is written to coordinate all these tools and ensure the flow remains compliant and explainable. Here is the full prompt assembled:

You are IndexAgent for our bank. Your job is to narrow a large universe of index funds/ETFs into a filtered, ranked shortlist that fits the customer’s stated intent, portfolio, and risk profile.

Do not place orders unless the customer explicitly approves.

When a customer request arrives via [Pattern:Queue:advisor.requests], begin a new advisory session and tag all messages with advisor_session_id and customer_id.

Pull live prices, spreads, ADV, and constituents for candidate funds from [Tool:MarketData] via [Pattern:Stream:prices]. If the stream stalls, fall back to the last 30s snapshot.

Fetch holdings, sector exposure, and concentration limits from [Tool:PortfolioService] via [Pattern:Request/Reply].

Retrieve risk band and suitability constraints from [Tool:RiskProfile] via [Pattern:Request/Reply].

Validate product eligibility and restrictions using [Tool:CustomerKYC] via [Pattern:Cache:5min].

Query index families and fund‑to‑benchmark mappings from [Tool:BenchmarksAPI] via [Pattern:Request/Reply].

Score candidates on expense ratio, liquidity (ADV/spreads), tracking error, diversification (top‑10 weight), historical drawdowns, tax efficiency, and fit to portfolio & risk constraints. Output a TOP‑3 shortlist with a plain‑language rationale and a small metrics table for each option. Include explain_trace=true.

Publish a compliance summary for review to [Agent:ComplianceAgent] via [Pattern:Pub/Sub:compliance]. If flagged, revise the shortlist or request human approval.

Present the shortlist and rationale to the customer. If the customer clicks BUY, emit an order‑intent event with an idempotency key and hand off to execution via [Pattern:Queue:trading.orders].

This single agent prompt demonstrates how Aiway unites multiple tools, a sub‑agent, and different messaging patterns in one cohesive flow. The IndexAgent coordinates MarketData, PortfolioService, RiskProfile, CustomerKYC, and BenchmarksAPI, while also publishing to a ComplianceAgent as a sub‑agent. It shows how queueing, streaming, request/reply, cache, and pub/sub patterns can be combined in one agent to orchestrate a complete advisory workflow. This highlights how a bank can use agentic infrastructure not only to answer general questions like Which S&P 500 index fund should I consider? but also handle specific sector‑based requests such as Show me index funds following the robotics industry. In both cases, the IndexAgent narrows the universe of options into a clear, compliant shortlist, leaving the customer in control of the final decision.

The Power of Integrated Agenting on Top of a Messaging Platform

The integrated approach changes the fundamental economics of enterprise AI deployment. When messaging and orchestration layers are designed together, entire classes of integration problems that typically consume months of development time are eliminated.

Organizations will continue using various approaches—some building on Kafka or RabbitMQ while layering orchestration and compliance tools on top, others gravitating toward integrated platforms that combine agent workflows with proven messaging infrastructure. Both approaches can succeed, but integrated platforms dramatically reduce expertise requirements and time-to-market.

KubeMQ’s specific advantages make this integration particularly effective. The platform features Kubernetes-native architecture that works naturally within modern cloud infrastructures, eliminating complex bridge configurations that often introduce failure points. Resource usage scales efficiently from proof-of-concept deployments to massive enterprise workloads handling millions of transactions, with automatic performance optimization as demand changes.

The underlying principle is fundamental: agentic AI requires enterprise messaging at its core. Without robust messaging infrastructure, AI agents cannot coordinate reliably at enterprise scale. The question isn’t whether messaging is needed—it’s whether to build it internally or leverage proven platforms that already address these challenges.

Conclusion

Enterprise AI success increasingly depends on the ability to deploy reliable, observable, and scalable agent systems quickly. The intelligence capabilities of AI are largely established—the challenge lies in making them work reliably within enterprise environments.

KubeMQ has revolutionized this space with KubeMQ-Aiway, transforming workflows that traditionally required months of manual integration into solutions deployable in weeks. The platform recognizes that enterprise messaging isn’t just about data movement—it’s about enabling the coordination, observability, and cost control that intelligent systems require.

As enterprises transition from proof of concept to production AI, success will depend less on agent capabilities and more on how reliably and efficiently these systems can be deployed at scale. The infrastructure foundation chosen today will determine whether AI initiatives become transformative business capabilities or expensive technical exercises.

Organizations that establish effective AI infrastructure foundations first will gain significant competitive advantages. Those that don’t will find themselves rebuilding infrastructure while competitors deploy working AI solutions.

Have a really great day!