Why Africa’s Markets Need a New Model

Africa doesn’t lack opportunity.

It lacks infrastructure for capital formation.

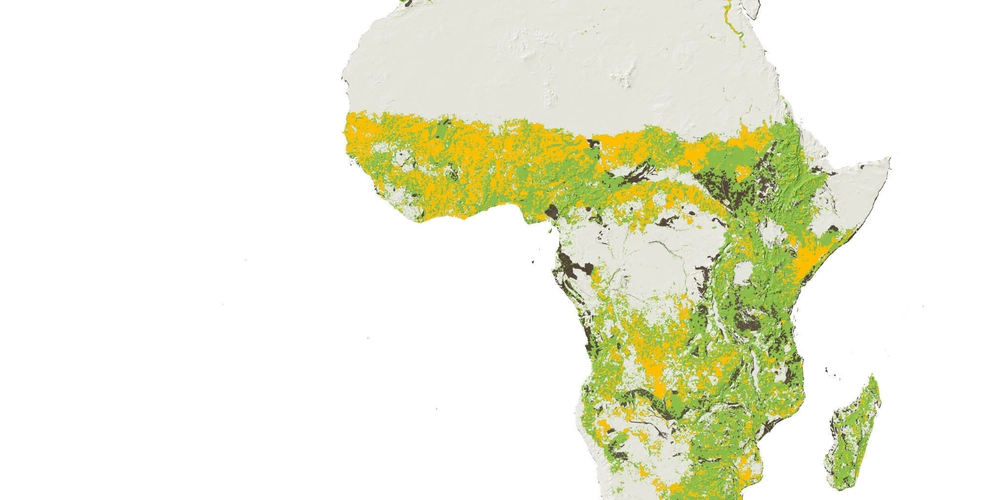

Across the continent, trillions of dollars in real-world value are held in land, energy, agriculture, and infrastructure, but much of it is financially invisible. Traditional systems were not designed to support microinvestments or cross-border participation. They rely on deep capital markets, trusted registries, and intermediaries, all of which are underdeveloped or inaccessible to most Africans.

As a result, Africa has abundant resources but limited access.

A young entrepreneur in Nairobi can create an app that has a global user base but cannot raise $5,000 in local credit. A Lagos developer can tokenize a building in code much faster than a property deed can be verified. Meanwhile, billions of dollars in diaspora capital are sent home via remittances, but almost none of it is invested in yield-bearing opportunities.

Tokenization changes that equation.

By converting ownership rights in real-world assets (RWAs) into blockchain-based digital tokens, Africa can establish markets before they mature, allowing for participation, liquidity, and transparency in areas where traditional infrastructure is still catching up.

"Africa does not need to catch up with global markets. It can create new ones from the ground up, on-chain.

Think about this: Africa’s real estate market is expected to exceed $1.4 trillion by 2030, but less than 1% of that total is institutionally accessible. Tokenization can make the same assets investable, tradable, and fractional, converting idle capital into active liquidity.

This is not speculative. Globally, the tokenization market has already reached $24 billion in 2025, having grown nearly fivefold in three years with forecasts predicting $30 trillion by 2034. Even if Africa only contributes 1%, it has the potential to transform its investment landscape.

Why Tokenization Works for Africa

Africa has a tendency to skip steps. When legacy systems fail, it creates new rails entirely.

Mobile money did it first. M-Pesa in Kenya, OPay in Nigeria, and Wave in Senegal demonstrated that financial inclusion does not require decades of bank infrastructure but rather the right technology and trust model.

Tokenization has the potential to be Africa’s next big breakthrough.

Where mature economies struggle with outdated registries and legal inertia, Africa can create native digital asset ecosystems that are transparent, compliant, and interoperable from the start.

Imagine a world where:

- Real estate projects in Nairobi issue tokenized property shares that are available to investors in Lagos and London.

- Ghana’s renewable energy farms raise micro-capital from diaspora investors.

- SMEs in Rwanda create on-chain revenue-sharing tokens for their communities.

Tokenization makes these scenarios technologically and economically feasible.

Because it creates new rails rather than relying on existing ones.

Each token becomes a digital certificate of ownership that is verified on-chain, tradable in real time, and available globally.

Another advantage for Africa is a young, digitally savvy population that already transacts online, understands mobile finance, and adapts quickly to new systems.

"Where legacy systems see risk, emerging markets see opportunity, because they can start over."

If mobile money connected Africa to payments, tokenization has the potential to connect Africa to capital.

Technology alone doesn’t unlock transformation.

Trust does.

For tokenization to thrive in Africa, the foundation must be built on verified data, transparent governance, and adaptive regulation. Without that, even the best platforms will face skepticism, not because people are opposed to innovation, but because they have seen far too many systems promise access only to deliver chaos.

This is where leadership and policy innovation must meet.

Frameworks like the U.S. GENIUS Act or Europe’s MiCA show how tokenized assets can be regulated without ceding monetary control. Africa does not need to replicate them; instead, it can adapt to them.

African regulators can create a governance blueprint that encourages innovation while also protecting citizens by developing region-specific frameworks, beginning with pilot sandboxes in real estate, carbon credits, and infrastructure.

The formula for trust is simple but non-negotiable:

- Transparency: On-chain verification of asset ownership and audits.

- Inclusion: Rules that welcome small investors, not just institutions.

- Education: Clear communication to help citizens understand tokenized products.

"Tokenization isn't about replacing banks; it's about changing the way markets gain trust."

And trust, once established, compounds.

Imagine tokenized housing programs backed by verified registries. Imagine a continent where youth can invest $10 in a solar farm or diaspora professionals can co-own local properties with verified proof.

This is an infrastructure project, not a utopian dream. One constructed not with concrete, but with code, compliance, and shared intent.

Building Markets Before They Mature

Africa stands at a crossroads between inherited systems and designed systems.

It can either wait for traditional markets to mature or create digital ones that grow organically alongside its people, assets, and goals.

Tokenization introduces not only new technology but also new economics:

- Markets where small investors are stakeholders.

- Capital that flows transparently and inclusively.

- Ownership that’s not limited by geography, paperwork, or privilege.

The opportunity is not simply to participate in the global tokenization wave, but to lead it.

The question is not whether tokenization will come to Africa.

It’s who will shape it first.

Africa’s markets do not have to wait for maturity; they can evolve digitally right now.

What sector do you think should be tokenized first? real estate, carbon, or infrastructure?”