Financial regulators in Canada this week levied $176 million in fines against Cryptomus, a digital payments platform that supports dozens of Russian cryptocurrency exchanges and websites hawking cybercrime services. The penalties for violating Canada’s anti money-laundering laws come ten months after KrebsOnSecurity noted that Cryptomus’s Vancouver street address was home to dozens of foreign currency dealers, money transfer businesses, and cryptocurrency exchanges — none of which were physically located there.

On October 16, the Financial Transactions and Reports Analysis Center of Canada (FINTRAC) imposed a $176,960,190 penalty on Xeltox Enterprises Ltd., more commonly known as the cryptocurrency payments platform Cryptomus.

FINTRAC found that Cryptomus failed to submit suspicious transaction reports in cases where there were reasonable grounds to suspect that they were related to the laundering of proceeds connected to trafficking in child sexual abuse material, fraud, ransomware payments and sanctions evasion.

“Given that numerous violations in this case were connected to trafficking in child sexual abuse material, fraud, ransomware payments and sanctions evasion, FINTRAC was compelled to take this unprecedented enforcement action,” said Sarah Paquet, director and CEO at the regulatory agency.

In December 2024, KrebsOnSecurity covered research by blockchain analyst and investigator Richard Sanders, who’d spent several months signing up for various cybercrime services, and then tracking where their customer funds go from there. The 122 services targeted in Sanders’s research all used Cryptomus, and included some of the more prominent businesses advertising on the cybercrime forums, such as:

-abuse-friendly or “bulletproof” hosting providers like anonvm[.]wtf, and PQHosting;

-sites selling aged email, financial, or social media accounts, such as verif[.]work and kopeechka[.]store;

-anonymity or “proxy” providers like crazyrdp[.]com and rdp[.]monster;

-anonymous SMS services, including anonsim[.]net and smsboss[.]pro.

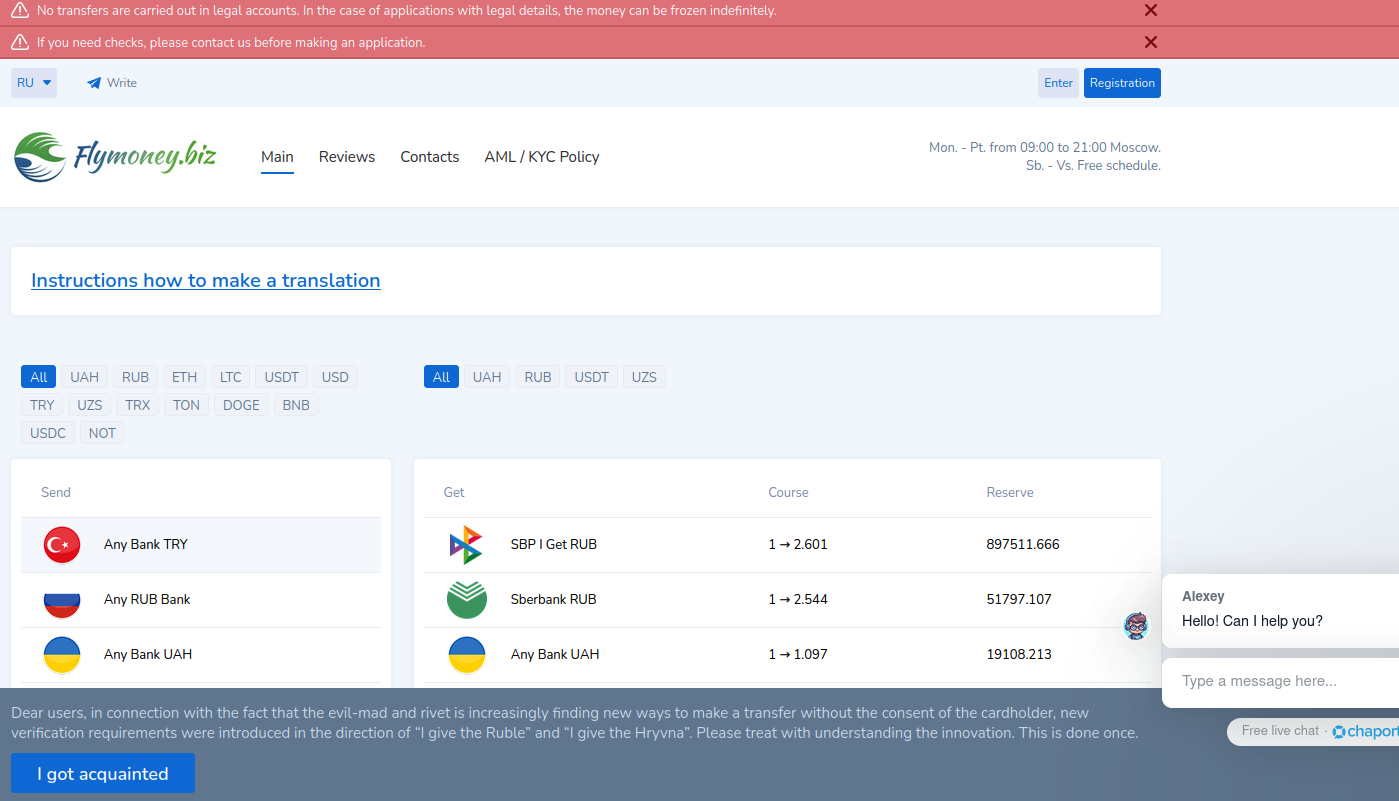

Flymoney, one of dozens of cryptocurrency exchanges apparently nested at Cryptomus. The image from this website has been machine translated from Russian.

Sanders found at least 56 cryptocurrency exchanges were using Cryptomus to process transactions, including financial entities with names like casher[.]su, grumbot[.]com, flymoney[.]biz, obama[.]ru and swop[.]is.

“These platforms were built for Russian speakers, and they each advertised the ability to anonymously swap one form of cryptocurrency for another,” the December 2024 story noted. “They also allowed the exchange of cryptocurrency for cash in accounts at some of Russia’s largest banks — nearly all of which are currently sanctioned by the United States and other western nations.”

Reached for comment on FINTRAC’s action, Sanders told KrebsOnSecurity he was surprised it took them so long.

“I have no idea why they don’t just sanction them or prosecute them,” Sanders said. “I’m not let down with the fine amount but it’s also just going to be the cost of doing business to them.”

The $173 million fine is a significant sum for FINTRAC, which imposed 23 such penalties last year totaling less than $26 million. But Sanders says FINTRAC still has much work to do in pursuing other shadowy money service businesses (MSBs) that are registered in Canada but are likely money laundering fronts for entities based in Russia and Iran.

In an investigation published in July 2024, CTV National News and the Investigative Journalism Foundation (IJF) documented dozens of cases across Canada where multiple MSBs are incorporated at the same address, often without the knowledge or consent of the location’s actual occupant.

Their inquiry found that the street address for Cryptomus parent Xeltox Enterprises was listed as the home of at least 76 foreign currency dealers, eight MSBs, and six cryptocurrency exchanges. At that address is a three-story building that used to be a bank and now houses a massage therapy clinic and a co-working space. But the news outlets found none of the MSBs or currency dealers were paying for services at that co-working space.

The reporters also found another collection of 97 MSBs clustered at an address for a commercial office suite in Ontario, even though there was no evidence any of these companies had ever arranged for any business services at that address.