In today’s digital-first business environment, data security has evolved from a compliance checkbox to a critical business imperative. Organizations across industries face mounting pressure to protect sensitive financial information while maintaining operational efficiency. Microsoft Dynamics 365 Business Central’s 2025 Wave 2 release introduces powerful new features that address these challenges head-on, particularly in the realm of data protection and financial forecasting.

The Growing Need for Data Protection in ERP Systems

Data breaches and privacy violations continue to dominate headlines, with financial information remaining among the most targeted assets by cybercriminals. Enterprise Resource Planning (ERP) systems like Dynamics 365 Business Central serve as the central nervous system of modern businesses, housing everything from customer data to financial projections. This centralization, while beneficial for operational efficiency, creates a single point of vulnerability that organizations must protect rigorously.

The challenge intensifies when considering regulatory compliance requirements. GDPR, CCPA, and industry-specific regulations demand that businesses implement robust data protection mechanisms. Failure to comply can result in substantial fines, reputational damage, and loss of customer trust. Organizations need ERP solutions that embed security at the foundational level rather than treating it as an afterthought.

Introducing the Concealed Text Field Type: A Game-Changer for Data Security

Microsoft’s 2025 Wave 2 release for Business Central introduces the “concealed” text field type, a feature specifically designed to address the protection of sensitive data within the platform. This new field type represents a significant advancement in how Business Central handles confidential information, offering organizations a practical and effective mechanism to safeguard private data.

The concealed field type comes equipped with a MaskType property that fundamentally changes how sensitive information is displayed and protected within the system. Unlike traditional data masking solutions that require extensive customization or third-party tools, this native functionality integrates seamlessly into Business Central’s architecture. When implemented, the concealed field type automatically masks sensitive data in user interfaces while maintaining the actual values in the database for legitimate business operations.

This feature is particularly valuable for protecting information such as social security numbers, bank account details, credit card information, and other personally identifiable information (PII) that organizations must handle with care. Development teams can implement this protection without writing complex custom code, significantly reducing implementation time and potential security gaps.

The flexibility of the MaskType property allows organizations to customize how data appears to different user roles. This granular control ensures that employees only see the information necessary for their job functions, adhering to the principle of least privilege. System administrators can configure masking patterns that balance security with usability, ensuring that authorized personnel can still perform their duties effectively.

Cash Flow Forecasting: Predicting Financial Health with Confidence

While data security protects what you have, effective cash flow management ensures your business continues to thrive. Cash flow represents the lifeblood of any organization, and the ability to accurately forecast future cash positions can mean the difference between strategic growth and financial distress. Dynamics 365 Business Central’s cash flow forecast feature provides businesses with a sophisticated yet accessible tool for financial prediction.

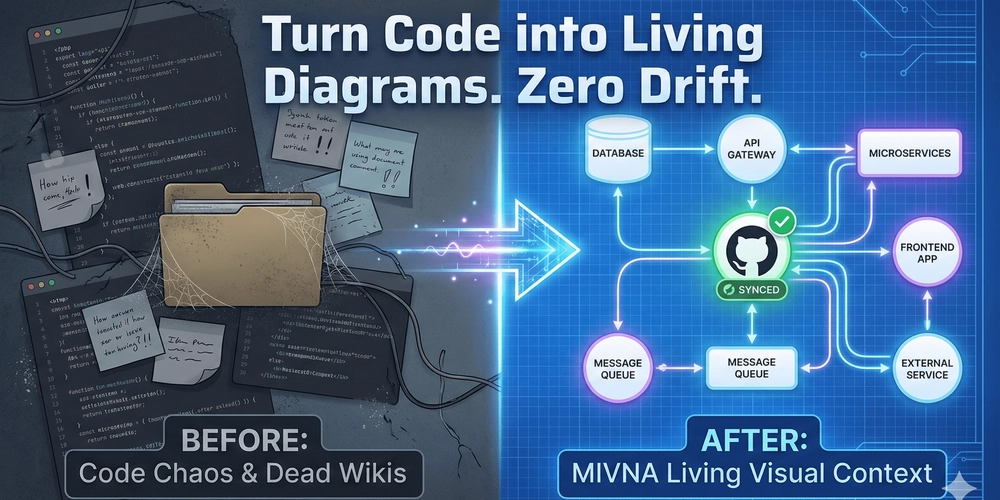

The cash flow forecast functionality aggregates data from multiple sources within Business Central, including accounts receivable, accounts payable, purchase orders, sales orders, and historical transaction patterns. By analyzing these data streams, the system generates predictive insights that help finance teams anticipate cash shortages or surpluses weeks or months in advance.

What makes Business Central’s approach particularly valuable is its integration depth. Rather than requiring manual data entry or complex data imports, the forecast engine automatically pulls information from existing business processes. When sales representatives create sales orders or procurement teams generate purchase orders, this data feeds directly into cash flow projections, ensuring forecasts remain current and accurate.

The system’s user-friendly interface presents complex financial projections in easily digestible visualizations. Finance teams can quickly identify periods of potential cash constraints and take proactive measures, such as adjusting payment terms, accelerating collections, or securing short-term financing. This forward-looking visibility transforms financial management from reactive problem-solving to strategic planning.

Organizations can also leverage scenario planning capabilities to model different business conditions. What if sales increase by twenty percent? How would delayed customer payments impact cash position? These what-if analyses enable better decision-making and risk management, providing executives with the confidence to pursue growth opportunities while maintaining financial stability.

How Vaden Consultancy Empowers Your Digital Transformation

At Vaden Consultancy, we specialize in helping organizations unlock the full potential of Microsoft Dynamics 365 solutions. As a certified Dynamics 365 partner, we bring deep technical expertise and industry-specific knowledge to every engagement. Our team understands that implementing ERP systems involves more than technical configuration—it requires aligning technology with business objectives, processes, and people.

Our comprehensive service portfolio includes implementation, customization, integration, training, and ongoing support for Dynamics 365 Business Central and the entire Dynamics 365 ecosystem. Whether you’re migrating from legacy systems, upgrading from older Dynamics versions, or implementing Business Central for the first time, Vaden Consultancy provides the guidance and technical expertise to ensure success.

We recognize that security and financial management capabilities like the concealed field type and cash flow forecasting represent significant value, but only when properly implemented and configured for your specific business needs. Our consultants work closely with your teams to understand your unique requirements, regulatory obligations, and operational workflows, designing solutions that enhance both security and efficiency.

Conclusion

The convergence of enhanced data protection and sophisticated financial forecasting in Dynamics 365 Business Central’s latest release demonstrates Microsoft’s commitment to addressing real-world business challenges. The concealed text field type provides organizations with powerful, native data protection capabilities, while advanced cash flow forecasting delivers the financial visibility needed to navigate uncertain economic conditions.

For organizations seeking to maximize their Dynamics 365 investment, partnering with experienced consultants like Vaden Consultancy ensures these powerful features are implemented effectively and aligned with broader business objectives. In an era where data security and financial agility determine competitive success, having the right tools and the right partner makes all the difference.