In the rapidly evolving world of financial markets, traders are no longer limited to intuition, experience, and manual analysis. The rise of Artificial Intelligence (AI) has transformed how trades are executed, risks are managed, and opportunities are identified. But how exactly does AI-assisted trading differ from traditional methods—and which delivers the edge?

Let’s break it down.

1. The Foundation: Human Insight vs. Machine Intelligence

Traditional Trading:

Historically, trading has relied heavily on human judgment. Traders use technical charts, economic data, and market sentiment to make decisions. Emotional intelligence, experience, and pattern recognition play key roles.

AI-Assisted Trading:

AI systems, on the other hand, process millions of data points in seconds. They identify correlations and micro-trends that even seasoned analysts might miss. These algorithms learn continuously, adapting to new patterns without fatigue or bias.

Example: While a traditional trader might manually track a few indicators, an AI algorithm can analyze 100,000+ variables across multiple timeframes—simultaneously.

2. Speed and Efficiency

Traditional:

Execution speed depends on human reaction time and market awareness. Even a few seconds of delay can mean missing an opportunity or suffering a loss.

AI-Assisted:

AI-driven systems execute trades within milliseconds. Automation eliminates delays, allowing traders to capitalize on micro-movements and arbitrage opportunities that humans simply can’t catch.

Result: Faster decisions, tighter spreads, and better precision.

3. Emotion and Bias: The Human Factor

Traditional:

Fear and greed often influence trading decisions. Overconfidence after a win or hesitation after a loss can lead to inconsistent outcomes.

AI-Assisted:

Algorithms don’t feel emotions. They follow logic and data, ensuring decisions are consistent and objective—even during volatile market conditions.

Insight: Emotion-free trading doesn’t mean AI replaces human oversight—it complements it by removing noise from decision-making.

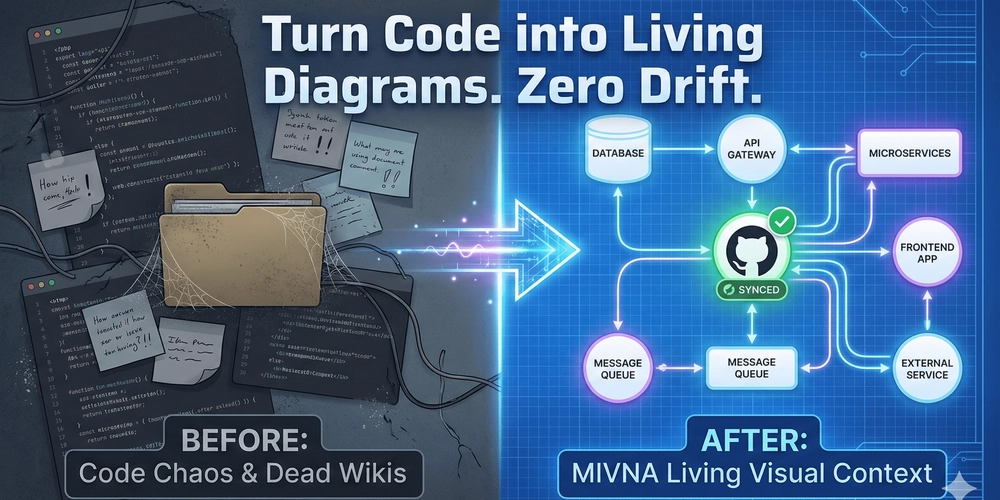

4. Data Processing and Predictive Power

Traditional:

Manual analysis limits how much data a human can process. Traders may focus on a few assets or indicators at a time.

AI-Assisted:

AI thrives on data. It leverages Natural Language Processing (NLP) for sentiment analysis, machine learning for predictive modeling, and big data analytics for cross-market insights.

Outcome: More informed predictions and early detection of market shifts.

5. Adaptability and Continuous Learning

Traditional:

Human traders adapt through experience—but adaptation takes time and often comes after losses.

AI-Assisted:

AI models learn in real time. They evolve with each market fluctuation, continuously refining strategies through backtesting and reinforcement learning.

**Advantage: **Self-improving systems that get smarter with every trade.

6. Risk Management

Traditional:

Risk is assessed based on experience, intuition, and historical data. However, emotional bias and limited datasets can lead to blind spots.

AI-Assisted:

AI systems use predictive analytics to detect anomalies and manage portfolio risk dynamically. They adjust positions automatically to maintain desired exposure levels.

Result: Smarter, data-driven risk management that minimizes losses and maximizes consistency.

7. The Hybrid Future: Human + AI

The debate isn’t about replacing traders—it’s about empowering them. The most successful traders combine human intuition with AI precision. Humans provide strategic direction and context; AI delivers speed, scale, and objectivity.

Human intelligence sets the vision. AI ensures flawless execution.

Conclusion: The Edge Belongs to the Adaptive

As financial markets become more complex and data-driven, AI-assisted trading isn’t just a trend—it’s the future. While traditional trading will always have its place in strategy and sentiment interpretation, the edge increasingly lies with those who embrace intelligent automation.

Address : 101 Greenfield Road, E1 1EJ London, United Kingdom